Calculate costs and compliantly pay your team

We remove the HR challenges of hiring and paying global teams. As your partner, we ensure local tax compliance, accurate payroll deductions, and on-time employee payments.

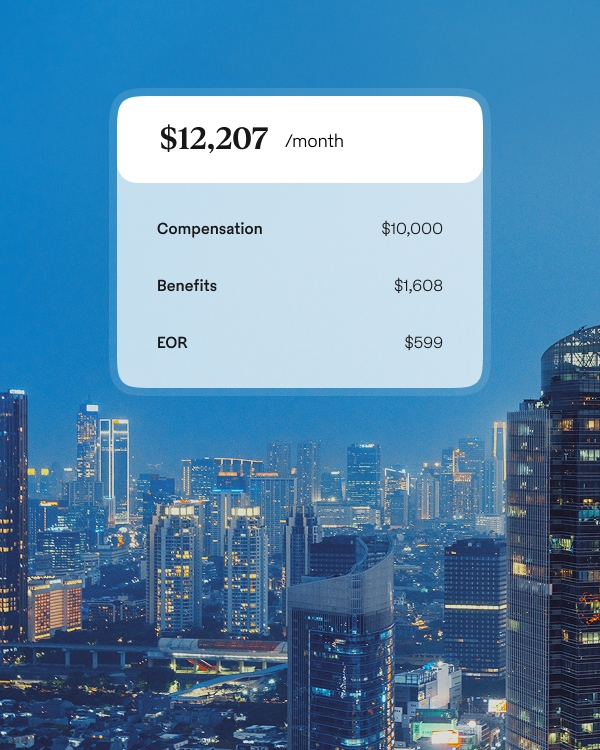

Predict payroll costs with 99.63% accuracy

Our labor burden calculations are 99.63% accurate, so you can forecast payroll costs confidently. We precisely calculate employer contributions and VAT across markets, giving you reliable numbers to plan your workforce budget and avoid costly surprises.

Compliance in every country

Mitigate the risk of unforeseen costs and stay ahead of ever-changing payroll regulations with in-country support by your side. Our deep knowledge and proven track record mean compliant payroll for every employee, regardless of where they work.

Learn how to calculate employee costs

In this video, we cover five key factors to calculating employee cost: gross annual pay, payroll taxes, onboarding costs, statutory benefits, and tax considerations.

FAQ

-

How do I stay compliant while paying global employees?

The easiest and most cost-effective way to stay compliant while paying global employees is to partner with an employer of record (EOR).

An EOR serves as the legal employer and handles onboarding, payroll, benefits administration, and compliance for your global team. Additionally, an EOR mitigates common payroll risks like incorrect contribution calculations, permanent establishment, and changing tax regulations.

-

How does Pebl help calculate employee costs?

Our in-house and in-country experts consult local employment regulations to provide accurate employee cost breakdowns. We rigorously audit and update our calculations to ensure accurate and transparent pricing.