What you need to know:

3 in 5 want flexibility in how and when they get paid.

Roughly 1 in 5 are considering crypto and other payment options.

Preferences and 2030 outlook differ across the U.S., U.K., and Germany.

The future of payroll is flexible.

The next wave of flexibility isn’t about where people work—it’s how they’re paid. From “hire anywhere” to “pay any way,” payroll is evolving as employees ask for choice and leaders prepare for different ways to pay employees across currencies, equity, and crypto.

Employees want choice. Leaders need a reliable partner

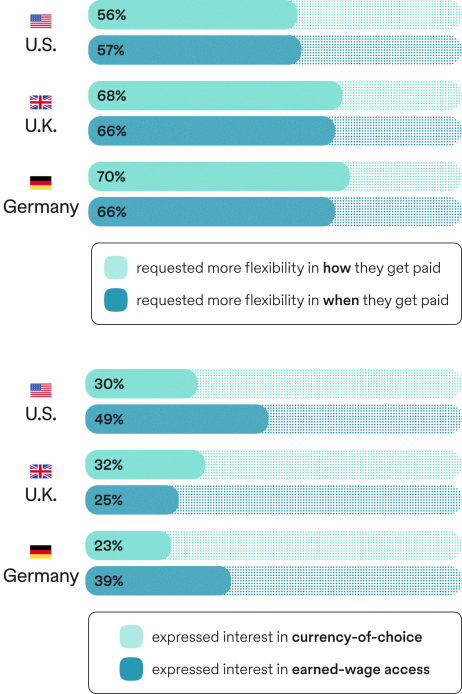

Workers want flexibility in how and when they get paid.

What it means for business

Employee desire for flexible compensation (how, when, and in what currency) is increasing. Employees want mixed pay models including crypto, USD-based currency, equity, and local market currencies.

Employers need strategies on how to pay employees compliantly to meet employee expectations.

Worker Payroll Expectations

Do your workers want alternative payroll options?

Specifically, they want:

Employers are exploring crypto and alternative payroll globally.

Across markets, roughly 1 in 5 employers are looking into crypto payroll compensation strategies.

What it means for business

Interest in crypto compensation is pretty uniform across the globe, with the U.K. and U.S. both at 20% and Germany at 21%, suggesting this is becoming a competitive advantage to attract and retain talent.

And by 2030, leaders believe compensation for global talent will diversify well beyond the traditional paycheck.

Alternative Payroll

1 in 5 respondents are exploring how to pay employees in crypto or alternative payment options:

By 2030, what forms of compensation do you believe will be most common for global payroll?

Payroll expectations look different in every market.

From the U.S. to Germany, alternative payroll takes many forms.

Flex-pay may be mainstream, but it splits by region.

While one in five companies across markets are exploring how to pay employees with crypto or alternative payroll, regional patterns tell a more detailed story.

What it means for business

Every market has its nuances, and they show up in the data.

For example, the U.S. is less interested in alternative payroll than its European counterparts.

Meanwhile, Germany has little interest in currency-of-choice, and the U.K. lags behind the U.S. and Germany in earned-wage access.

Flexible Payroll

Do your workers/talent want more flexible pay options?

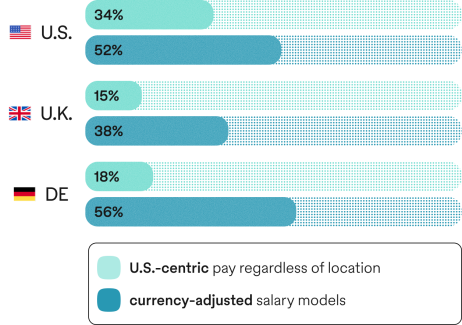

Unsurprisingly, the U.S. intends to keep a U.S.-centric pay model.

Meanwhile, European countries are exploring different ways to pay employees.

What it means for business

U.S. companies plan to continue paying in USD, while the rest of the globe is shifting away from it.

Also notable is the U.K.’s seeming reluctance to adopt modern, location-aware pay, lagging behind the U.S. and Germany, potentially hurting their ability to compete in global hiring.

Regional Payroll

How is your company evolving its compensation strategies for global talent?

To prepare for global payroll, prepare for alternative payroll.

The challenge for HR is no longer whether to offer it—but how to implement it without creating misalignment across regions—or compliance risks.

Give employees choice. Keep compliance intact.

To compete for talent, companies will need payroll flexibility—securely, legally, and at scale. Offering different ways to pay employees compliantly signals innovation and builds trust with global teams. In many markets, choice is moving from perk to expectation.

Your peers are planning for alternative payroll. Are you?

Organizations are laying the groundwork for alternative pay models—from timing to currency choice. See how leaders in your region are preparing.

How we conducted the 2025 Beyond Salary Report Survey

The 2025 Beyond Salary Report is sourced from Pebl's 2025 Global Hiring Survey. This inaugural survey of 423 HR and Finance leaders at the director level and above was conducted online by Researchscape International for Pebl between July 29 and August 20, 2025. Respondents, based in the U.S., U.K., and Germany, worked at companies with 100–999 employees and $25–49M in revenue, each with at least some in-country staff. Results were weighted to be representative.