Pay teams anywhere without entity setup

Get expert helpGlobal hiring really is great—with the advent of remote work, you are no longer restricted to a single talent pool. You can hire anyone! Of course, that also means that talent can shop their services around the globe—and there are bound to be competitive offers out there. That’s where equity compensation comes in.

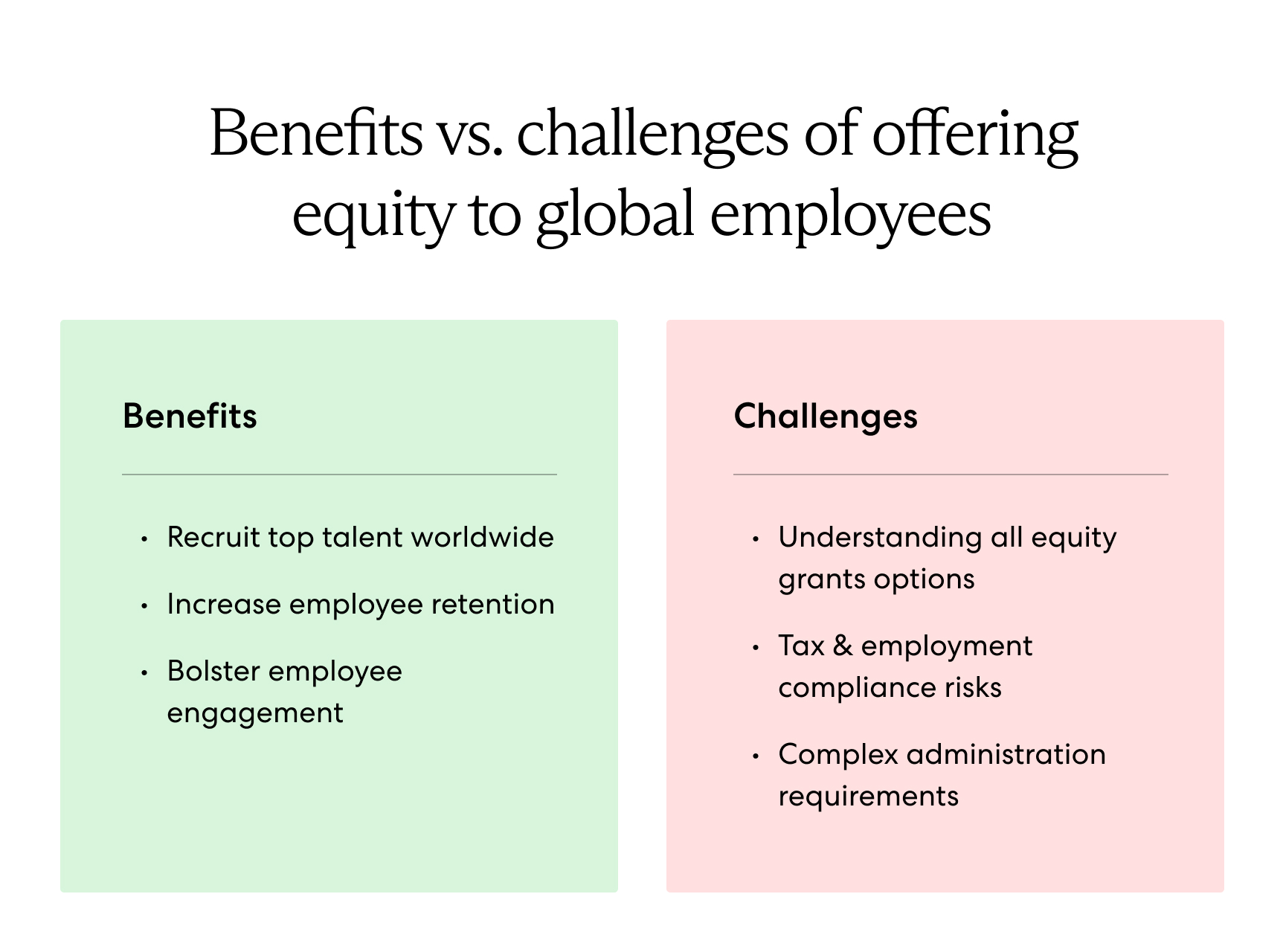

One of the most effective strategies for employers to attract and retain talent worldwide is to offer equity compensation. By granting a small percentage of company ownership, employers set themselves apart from the competition, boost employee engagement, and reduce employee turnover.

As companies embrace remote work and build distributed teams across borders, many employers face challenges with granting stock options and other equity awards to remote, hybrid, and global team members. Employers must familiarize themselves with available equity options and comply with country-specific tax and employment laws.

Read on to discover key considerations for granting stock options and other equity awards to distributed teams, including how to avoid the risks of noncompliance across different work arrangements and jurisdictions.

What are equity awards?

Equity awards refer to a range of equity compensation (either share-based or cash-settled), such as Nonqualified Stock Options (NSO), Restricted Stock Awards (RSA), Restricted Stock Units (RSU), and Phantom Units. Each works differently and either grants employees company ownership or rewards them in proportion to the company’s valuation.

Sixty-three percent of employees under 30 would consider a lower salary in return for a higher equity stake, up from 41% in 2021.

7 common forms of equity compensation

Many employers offer different forms of equity as direct compensation to their employees across remote, hybrid, and global teams. Below are the seven most common equity compensation forms, along with their considerations for distributed workforces.

Restricted stock awards (RSAs)

RSAs are a type of equity award that grants employees company stock but with some restrictions. Employees cannot sell them until the shares vest, usually following a specified vesting schedule or liquidation event. RSAs can be particularly effective for distributed workforces as they provide actual ownership regardless of location.

Restricted stock units (RSUs)

RSUs are a promise that an employee will receive common company stock based on certain vesting conditions—usually the passing of a specified time period (or vesting period). RSUs typically do not include shareholder rights, nor do they pay dividends. Employees rarely have to pay for RSUs and do not own the shares until the vesting period lapses.

Phantom units

Phantom units give employees many of the same benefits as stock ownership without actually granting them stock. Phantom units—also referred to as shadow equity—follow the company stock’s price movements and pay out cash in place of shares. International employees often prefer this option due to its simplified compliance requirements.

Incentive stock options (ISOs)

ISOs are statutory stock options available exclusively to employees in the United States and provide specific tax benefits to employees of U.S. companies. ISOs are considered qualified awards, which means U.S. employees pay no tax when they receive the grant option or when they exercise the grant. They only pay capital gains tax when they sell the stock.

Additionally, ISOs typically require a direct relationship between the issuer and the participant. Note that ISOs are not available to remote or international employees outside the U.S.

Nonqualified stock options (NSOs)

NSOs give employees the right to purchase company stock at a predetermined price. These stock options typically replace some of the cash compensation employees receive from their employment.

Employees must pay income tax on the difference between the option’s price and the stock value at the time they exercise the options. NSOs offer more flexibility for global and remote teams as they don’t have the same geographic restrictions as ISOs.

Further reading: Stock Options vs. Stock Grants

Stock appreciation rights (SARs)

SARs are a form of compensation linked to the value of the company stock over a specific time period. After the vesting period, employees can exercise their SARs. However, employees do not pay the exercise price. They receive the sum of the increase in the stock value in a cash payment or shares. SARs work well for distributed teams since they don’t require stock ownership transfers across borders.

Performance share units (PSUs)

PSUs are shares that employers grant to employees based on company performance. The number of shares an employee receives depends on key company performance metrics over a specific time period. PSU awards can also be graded, with multiple vesting points relative to the company’s overall performance.

Benefits of offering equity to foreign employees

Granting stock options and other equity awards to distributed teams benefits you and your distributed workforce in many ways. An equity incentive plan can help you attract and retain top talent worldwide, increase employee retention, and boost employee engagement across all work arrangements.

Recruit top talent around the world

Many companies aren’t familiar with how to grant equity awards to remote and global team members and, therefore, don’t offer these benefits. By including equity awards in your global employee benefits package, your company stands out as an attractive destination for top candidates, regardless of their location or work arrangement. Company ownership also helps employees feel like they are a part of your team, whether they work remotely, in a hybrid model, or internationally.

Increase employee retention

Since the vesting schedule is often tied to an employee’s tenure with the company, granting equity awards can incentivize employees to remain with the company and contribute to its long-term development. This benefit is particularly valuable for remote and global teams where traditional retention strategies may be less effective or where location-based pay discrepancies result in remote workers earning less.

Bolster employee engagement

In many cases, the better the company performs during the vesting period, the greater the bonus for the employee when a distribution event occurs (typically at exercise for stock options and at vest for RSUs/PSUs). If an award’s vesting terms are directly linked to company performance, employees are more likely to be collaborative and committed in the long run. This shared success model works especially well for distributed teams who may feel disconnected from day-to-day operations.

Create a competitive advantage in global talent markets

Offering equity compensation gives companies a competitive edge when recruiting talent across different regions and time zones. Many local employers in emerging markets don’t provide equity benefits, which can make these sort of offers more attractive to skilled professionals. This advantage becomes even more pronounced when recruiting for remote positions where candidates can choose from employers worldwide.

Challenges of offering equity to foreign employees

Companies that grant equity awards to distributed teams face many challenges. They must familiarize themselves with the range of available equity options, comply with local tax and employment laws, and learn how to offer equity awards across different jurisdictions and work arrangements.

Choosing the right compensation option

Each available equity award has different implications for your business and your talent. Determining the best ones for your company is a time-consuming process and depends on several factors, such as your specific goals, company size, and company structure:

- Is your stock price already unaffordable for your employees? RSU offerings are worth considering, as they allow your employees to attain shares without paying an exercise price.

- Do you plan to offer equity to contractors? Many companies issue NSOs or RSUs as non-employee grants to contractors since these issuance types are not restricted to employees. This consideration becomes more complex with remote contractors who may work across multiple jurisdictions.

Compliance risks

Employers offering equity must also have a firm grasp of the local tax and employment laws of the employee’s country of residence. Remote and hybrid workers introduce additional complexity as they may work from different locations throughout the year. Employers must remember:

- Tax obligations vary worldwide. Some countries impose tax withholding and reporting when the employer grants an equity award, while others don’t impose withholding and reporting until the shares are vested or exercised. Remote employees may trigger tax obligations in multiple jurisdictions depending on where they work.

- Equity compensation can impact worker classification. Offering equity to a contractor establishes a more direct relationship with that individual, which may influence their classification. Employers should weigh the benefits of granting equity to contractors against the risk of misclassification.

It’s equally important to communicate equity-based tax filing and reporting requirements to your employees. Helping your employees stay safe and compliant ensures your equity plan remains an incentive and not a burden.

Administration can be complex

Before offering equity to employees, you must be prepared to compliantly and effectively administer your plan globally, which requires the following steps:

- Determine your company valuation. If your company is not publicly traded, you’ll need to establish the fair market value (FMV) of your company’s shares.

- Prepare an equity plan. Determine what types of equity you will offer as part of your compensation policy and their global tax implications. Consider how different equity types work for various employment arrangements.

- Register your plan with federal authorities. Familiarize yourself with local registration requirements and exemptions.

- Establish payroll processing and reporting. Set up global payroll processing and reporting that complies with the tax laws of each country in which you offer equity awards. Remote work arrangements may require additional payroll considerations.

Administering equity compensation as part of a global total rewards package is a complex process that poses compliance risks for companies that go it alone. Employers can avoid the risk of noncompliance penalties by working with a trusted global partner like Pebl (previously Velocity Global).

FAQs

Below are answers to commonly asked questions about granting equity awards to remote, hybrid, and global teams.

Can you grant ISOs to foreign employees?

In some cases, yes. If an employee works for a qualifying U.S. company, they can receive ISOs. However, depending on the tax legislation of the country where the foreign employee resides, they may not receive the same tax benefits that U.S. employees receive with ISOs. In this case, NSOs are often a better option for foreign employees.

Additionally, ISOs are only available to employees, not contractors, so remote contractors are not eligible to receive this type of equity compensation. ISOs are considered qualified awards, which means they typically require a direct relationship between the issuer and the participant.

Who is not eligible for employee stock options?

In many countries, most employees are eligible for employee stock options. However, in some countries, certain employees are excluded from this right, such as company promoters or directors who hold more than a specific percentage of the company’s outstanding equity shares. Remote contractors may also face eligibility restrictions depending on their classification and local labor laws.

How does remote work affect equity compensation compliance?

Remote work creates additional compliance complexity because employees may trigger tax obligations in multiple jurisdictions depending on where they work. Companies must understand payroll reporting and withholding rules for each location where remote employees are based, and employees need to understand their individual tax filing requirements across different jurisdictions. This is particularly challenging when remote employees travel or relocate during their vesting periods.

How are stock options granted to employees?

Employers grant stock options to employees through equity compensation plans. These plans are usually part of an employee benefits package. Stock options come in the form of regular call options that grant employees the right to buy shares at a certain price for a specific time period.

For distributed teams, companies typically work with global payroll providers or equity management platforms to handle the complexities of multi-jurisdictional compliance.

The easiest way to offer equity to your global team

In business you need every edge you can get, especially on the global stage. Not worrying about employee retention allows you to focus on what matters. Granting equity gives you a competitive edge over other companies vying for the best talent worldwide. However, navigating tax laws and employment legislation in multiple countries without on your own can be risky. Eliminate these risks by utilizing an experienced global partner like Pebl (previously Velocity Global).

Our Global Equity Program makes it easy to grant comprehensive equity packages to your distributed workforce. We partner with leading tax advisory firms to help offer compliant, locally tailored equity awards worldwide. We handle everything: registration, payroll processing, annual reporting, and coordinating withholding rates so you can rest easy.

Get in touch with Pebl (previously Velocity Global) today to learn how to confidently and compliantly grant equity awards to foreign employees.

This information does not, and is not intended to, constitute legal or tax advice and is for general informational purposes only. The intent of this document is solely to provide general and preliminary information for private use. Do not rely on it as an alternative to legal, financial, taxation, or accountancy advice from an appropriately qualified professional. The content in this guide is provided “as is,” and no representations are made that the content is error-free.

© 2025 Pebl (previously Velocity Global), LLC. All rights reserved.

Topic:

Payroll