Pay teams anywhere without entity setup

Get expert helpYou’re planning to expand your team. Maybe you’ve got your eye on that brilliant developer in Berlin, or you’re finally ready to hire that marketing expert in Paris everyone’s been talking about. You know roughly what you want to pay them—but do you know what they’ll really cost you?

That salary number you’re thinking about is just the starting point. The real cost of an employee includes everything from payroll taxes and benefits to the laptop they’ll need and that team retreat you’re planning for next quarter. And if you’re hiring globally, that opens up a whole new world of costs you probably haven’t considered yet.

Getting employee cost calculations wrong doesn’t just mess up your budget—it can derail your entire expansion plan. But when you get them right, you can make confident hiring decisions, plan realistic budgets, and grow your team without those “Wait, how much did we spend on payroll this month?” moments that keep finance teams up at night.

Whether you’re hiring your first international employee or scaling a global team, understanding the true cost of each hire helps you build sustainably.

This guide walks you through everything—from the obvious expenses to the hidden costs that catch most companies off guard, plus strategies to keep those per-employee expenses from spiraling out of control.

Because when you’re building something global, surprises are expensive. Let’s make sure you see them coming.

How do you calculate employee costs?

Think of employee cost calculation like putting together a puzzle—except half the pieces are hiding under other expenses you didn’t know existed.

The basic math is straightforward: add up everything you spend on an employee throughout the year, then break it down into whatever timeframe makes sense for your planning—annual, monthly, or hourly. But here’s where it gets interesting: “everything” includes way more than that salary figure you negotiated.

You’ve got the obvious stuff—gross salary and employer payroll contributions. Then there’s the not-so-obvious stuff that can catch you off guard, especially when you’re hiring internationally. Different countries have different rules about what employers must contribute, and those contributions can vary wildly from what you’re used to paying domestically.

Use our employee cost calculator below to see what hiring costs are in different countries. No surprises, just the real numbers you need to budget properly:

What makes this tricky is that employee costs aren’t the same everywhere. What you pay to hire someone in Germany looks very different from hiring in Singapore or Brazil. Local regulations, mandatory benefits, tax structures—they all shift the total cost in ways that can make or break your expansion budget.

We’ll walk you through the variables that drive these differences across markets, give you a simple formula that works for calculating annual employee costs, and share some strategies for keeping those per-employee expenses from spiraling beyond what you planned.

Because when you’re expanding globally, the last thing you want is to discover you’ve been budgeting with incomplete numbers.

8 variables that impact employee cost

Below are eight variables that impact employee cost.

1. Location

The location your employee resides in heavily impacts employee cost because labor legislation and cost of living vary between jurisdictions. For example, the statutory pension tax in Quebec in 2023 is 12.8% and applies to earnings between CA$3,500 and CA$66,600 while the same tax elsewhere in Canada is 5.95% and applies to the same earnings range.

Cost of living also varies worldwide, impacting employee wage rates between cities and countries. For instance, a junior graphic designer in New York City will likely require higher pay than a junior graphic designer in São Paulo because the cost of living is higher in New York City.

How to calculate the employee cost of living

Calculate the employee cost of living by adding up the costs of goods and services on which consumers spend their money in the employee’s city or region of residence. Costs include items like food, housing, and healthcare.

2. Industry

Your industry matters too—different sectors face different tax rates, which means your labor costs might look very different from a company in another industry, even if you’re hiring the same role in the same location. For example, the unemployment insurance tax rate for new employers in Pennsylvania is 10.59% in the construction sector and only 3.82% in the non-construction sector. As a result, actual employee cost varies widely between industries—even within one state.

3. Company size

Companies face different cost structures based on their size. Large companies can usually offer employees higher salaries than small companies can. Higher salaries often help reduce turnover, cutting hiring and onboarding costs in the long run.

In competitive markets, a small business may struggle to match the salaries of a larger company and face higher turnover, which leads to increased onboarding costs over time.

Additionally, payroll costs are typically lower for a large company as it is often cheaper, per employee, to run payroll for 5,000 employees than for 20 employees. At the same time, larger companies face higher overhead and hidden costs, such as rent and work equipment expenses.

4. Market conditions

The cost of hiring an employee also depends on market conditions. In an employer-driven market, the cost of attracting top talent may be lower than in an employee-driven market. However, in an employee-driven market, companies must offer more competitive salaries and generous employee benefits packages to attract and retain top talent.

5. Unions

Employees who are part of a union may cost more than non-unionized workers. Employers are subject to the minimum wage cap set by the employee labor union, which is usually higher than the minimum wage for non-unionized workers.

Union wages can also impact employers who don’t hire unionized workers: If employers operate in an industry with labor unions, they may have to offer higher wages to compete for top talent.

6. Turnover rate

Companies with high turnover rates spend resources hiring and onboarding multiple employees over time. Recruiting and onboarding costs vary depending on your hiring strategy, but they can include job-posting fees, recruiting software, background checks, and the time and resources your HR team spends to fill each vacancy.

Read on to learn valuable strategies for reducing employee turnover, such as offering tailored benefits packages to boost employee morale.

7. Roles and tasks

Experienced employees generally earn higher salaries than inexperienced employees. In a competitive market, an employee who can prove they have the rare skills and experience that a role requires can often demand a higher salary.

Over time, employers frequently offer additional supplementary benefits as employees remain with the company. Senior employees may receive more comprehensive benefits packages than employees in entry-level or mid-level positions, which impacts total employee cost.

8. Performance

The more productive your employees are, the more resources they save you. Poor employee productivity costs you more resources in the short term and increases your turnover rate. Companies may offer perks like performance bonuses, professional development funds, and additional paid time off to motivate employees and improve productivity.

Many strategies companies use to reduce employee costs can lead to increased costs elsewhere. For example, offering performance-based rewards is an added cost but may increase employee productivity and reduce turnover in the long run.

How to calculate the cost of an employee

Employee costs vary dramatically depending on the above variables. Payroll taxes, employee benefits, and other expenses further increase employers’ labor burden, making it harder to reach an exact calculation on their own.

Below is a general guideline for calculating annual mandatory employee costs beyond base pay.

1. Determine the employee’s gross annual pay

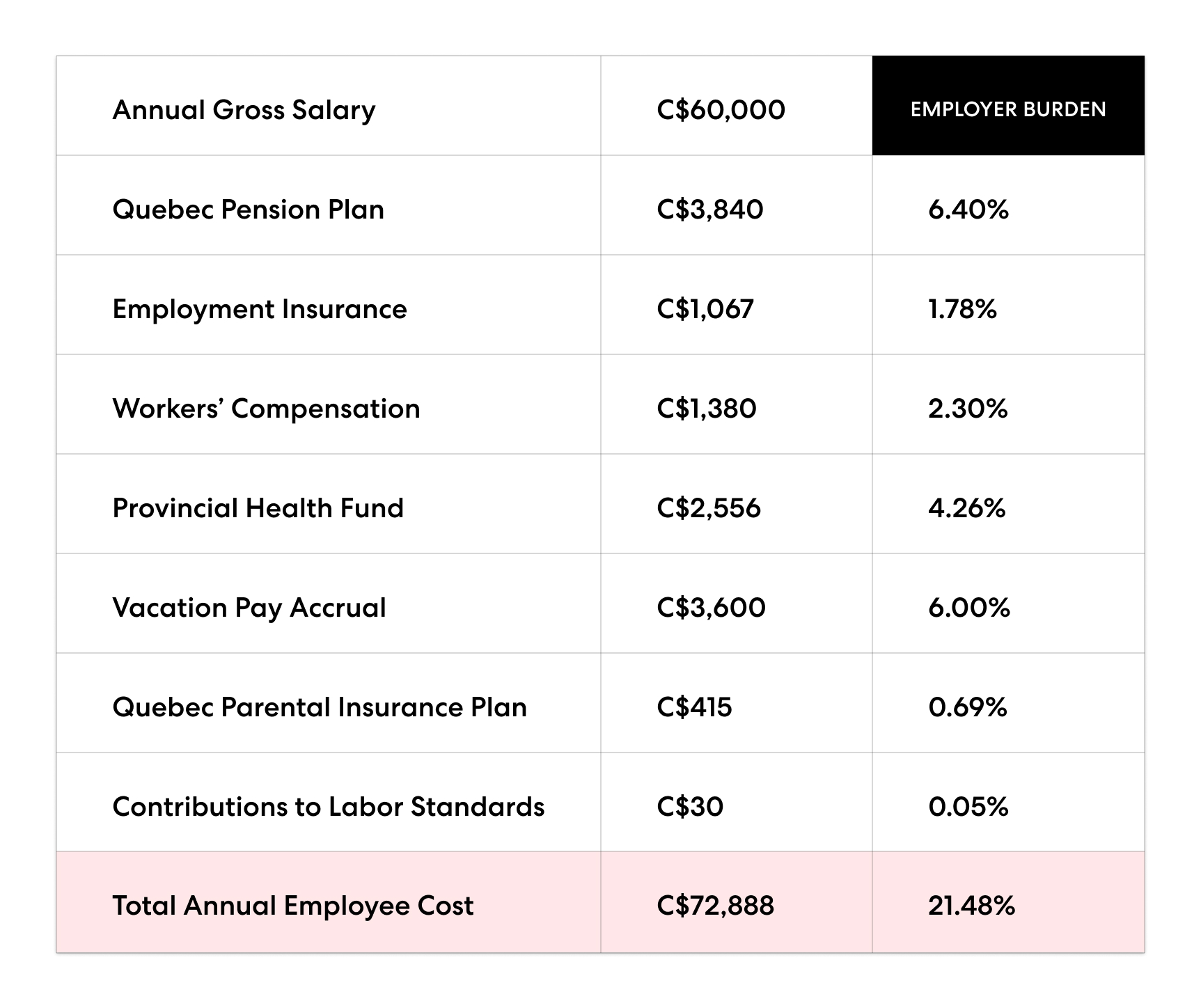

First, retrieve your employee’s gross annual pay before withholding taxes. In the example below, an employee from Quebec, Canada receives a gross annual salary of $C60,000.

2. Calculate payroll taxes

Next, calculate the total annual payroll taxes you must pay on your employee’s behalf. In Quebec, this includes several federal requirements plus two provincial requirements that only apply to employees in Quebec: labor standards and parental leave contributions.

The above table reflects 2023 rates which are subject to change.

3. Add any additional expenses

Sum up the total cost of any additional annual expenses associated with the employee, such as supplemental benefits, onboarding costs, and work equipment.

Some of these expenses, such as office rent and company retreats, are group expenses. To get the total group expense cost per employee, add up the group expenses and divide the sum by your total number of employees. Add this number to the other additional employee expenses.

In summary, add together the employee’s gross annual pay, annual payroll taxes, and total additional annual expenses to get the total annual employee cost. You can further divide this by months or hours to determine the employee’s total monthly or hourly cost.

8 expenses that matter when calculating employee cost

There’s a whole list of costs that go into employing someone—and some of them are sneaky. They’re the kind of expenses that seem small until you multiply them across your team, or they’re requirements you didn’t know existed until you started hiring in a new country.

Let’s walk through the eight expenses that make the biggest difference in your employee cost calculations. Miss any of these, and your budget projections will be off by more than you’d expect.

1. Recruitment costs

During the recruitment process, companies face hefty costs in the form of job posting fees, applicant tracking software (ATS) subscriptions, and the time, energy, and resources the HR team spends filling each vacancy.

If you outsource your recruiting needs to an external partner, you will likely have to pay a commission or retainer amounting to 15% to 30% of the base salary of any position they fill.

2. Onboarding costs

Onboarding lasts 90 days on average and can take an employee up to a year to reach their full performance potential. During this period, companies face various onboarding costs, such as:

- Paperwork. HR spends time and resources completing and filing paperwork for a new hire.

- Workspace setup. Some companies offer up to US$2,000 to help new remote employees set up their home office.

- Travel and relocation. This includes flight tickets for the employee and their family, as well as their accommodation upon arrival.

- Employee training and support. Employees spend time and resources training and overseeing the new hire’s daily work.

Helping new hires transition into their role sets the stage for their future with your company. It’s worth noting that, when done correctly, effectively onboarding international employees or local talent can drastically improve retention rates and reduce long-term employee costs.

Read more: How to Onboard Remote Employees With Success

3. Compensation

An employee’s base salary or base wages are the most significant cost to your company. It’s also one of the most easily measured costs. Salary or wage depends on several factors, such as their role, years of experience, and the market demand for talent with their skills.

Employees are also protected by minimum wage laws within their country or state. Employers must ensure their global compensation strategy complies with the employment laws of each jurisdiction in which they hire talent and is fair, consistent, and competitive.

4. Statutory benefits

Statutory benefits vary between countries and states and can make up a significant portion of true employee costs. For example, Mexican employment law entitles employees to an annual holiday bonus worth 15 days’ salary. However, Spanish employment law entitles employees to two annual bonuses, each worth one month’s salary.

Other statutory benefits may include medical insurance, workers’ compensation, and a pension fund.

Learn more: What Are Statutory Benefits?

5. Supplemental benefits

Supplemental benefits are additional benefits that employers offer employees beyond the statutory minimums. While not required by law, offering supplemental benefits is a useful way for employers to attract and retain talent and improve retention in competitive markets.

Supplemental benefits vary between locations and are mostly up to the employer’s discretion and compensation policy. For example, German law doesn’t require employers to pay an annual holiday bonus, but many German employers offer employees supplemental pay for it anyway.

Supplemental benefits may also come in the form of health insurance, dental and vision coverage, retirement plans, or parental leave.

Learn more: What Are Supplemental Benefits?

6. Taxes

Taxes vary widely between countries and states. For example, the employer contribution rate for social security tax in the Philippines is 9.5%, 16.75% in India, and 6.2% in the United States.

Even within countries, tax rates vary. Looking at the U.S., the unemployment insurance tax rate for new employers in Pennsylvania is either 3.82% or 10.59%, depending on the industry. However, in Florida, the unemployment tax rate for all new employers is 2.7%.

Generally speaking, employers must contribute to several federal or state funds for each employee, such as unemployment insurance, workers’ compensation, and medical insurance.

7. Overhead costs

Every business in every industry faces overhead costs. These are the basic, necessary amenities and services you need for your employees to carry out their daily duties and keep your business running.

Overhead costs vary depending on the type of business you run, but below are some of the most common costs:

- Office space rental. Rental costs vary, depending on the size and needs of your team.

- Utilities. Utilities include fees for heating, water, electricity, or fuel for company cars.

- Office supplies. Supplies include laptops, monitors, software, pens, paper, and other tools your team needs to perform their duties.

- Company uniforms. Uniform costs vary widely between industries.

Many of these costs depend on the total number of employees in your company. Expanding your team beyond a certain threshold may require more office space and higher rent, which impacts total per-employee cost.

8. Hidden costs

You might easily overlook the cost of things like meetings, ongoing training, seminars, and company retreats when calculating employee costs. The size of your team also impacts these hidden costs; as your team grows, meetings take up more time, and retreats become more expensive.

4 ways to reduce employee costs

Offering remote work, building a distributed workforce, streamlining your global payroll administration, and offering more attractive employee benefits packages are highly effective ways to reduce employee costs.

1. Offer remote work

Some employers report thousands of dollars in annual savings per employee by having employees work from home two to three days per week. When employees work remotely, employers can eliminate or cut down on many overhead costs associated with on-site employees, such as rent, utilities, and office supplies.

Remote employees also show increased productivity and lower absenteeism, improving retention and reducing long-term employee costs.

2. Build a distributed workforce

As remote work becomes more popular worldwide, more companies are starting to hire talent globally. By hiring employees in foreign markets, employers can source from a larger talent pool and easily find candidates with the skills they need at a price that fits their budget.

With a distributed workforce, employers also cut overhead costs such as rent, utilities, and office supplies and enjoy increased employee productivity and retention rates.

If you want to build a distributed workforce, consider partnering with a global employer of record (EOR). An EOR service simplifies the entire process of global hiring by handling onboarding, compliance, payroll, and benefits administration, so you can easily build and manage teams across borders.

Learn more: What Is an Employer of Record?

3. Streamline payroll operations

Streamlining payroll operations is an effective way to cut down on employee costs—especially for global companies that must pay international employees and navigate various currencies and languages.

A global payroll solution streamlines all payroll operations into one centralized platform and offers many benefits, such as:

- Accuracy and cost savings. Cut costs and eliminate errors by automating payroll administration.

- Compliance. Gain peace of mind that your payroll processes comply with local labor laws.

- Consistency. Retain top talent by delivering timely, accurate payments in every market worldwide.

- Efficiency. Save time and alleviate stress by using one centralized platform instead of multiple vendors.

A global payroll solution cuts costs and handles all the heavy lifting, allowing you to spend more time focusing on your day-to-day responsibilities and goals.

Learn more: What Is Global Payroll?

4. Improve talent retention with competitive benefits

Ongoing recruiting and onboarding costs that result from high turnover are hefty. One of the most critical factors that HR teams overlook when trying to improve retention rates is their global employee benefits packages.

By offering competitive, locally-tailored employee benefits packages, you show talent that you care for their well-being and drastically reduce employee turnover.

To truly move the needle, a global employee benefits package should go beyond statutory benefits and include things like additional healthcare coverage, wellness programs, employee assistance programs, or discounts on goods and services.

Get the guide: How to Retain Talent With Global Employee Benefits

Each of the above strategies can drastically reduce employee costs. However, employers who perform these calculations and implement these strategies may face financial and legal trouble if they are unsure of the compliance risks.

The risks of getting employee costs wrong

Getting employee cost calculations right isn’t optional—it’s what separates companies that scale successfully from those that hit expensive roadblocks along the way.

When you try to figure this out on your own, you’re essentially learning international employment law one mistake at a time. And those mistakes aren’t cheap. Miss a mandatory contribution here, miscalculate a tax requirement there, and suddenly you’re dealing with compliance penalties that could have funded your next hire.

Working with the wrong partner can be just as risky. Some providers promise low costs upfront but conveniently forget to mention all the extras until you’re already committed. Others simply don’t understand the local requirements well enough to get your calculations right the first time.

The result? You end up overpaying for basic services or, worse, facing penalties because your partner didn’t handle compliance correctly. Either way, those “savings” you thought you were getting quickly turn into expensive problems.

The smart move is partnering with someone who gets the calculations right from day one—because when you’re expanding internationally, there’s no room for expensive learning curves.

Noncompliance

Providing inaccurate contributions for costs related to statutory employee benefits leads to hefty fines, legal fees, lost business opportunities, and reputational damage. The risk of noncompliance is even greater for companies with a distributed workforce that must navigate complex labor laws in multiple countries.

The best way to eliminate compliance risks is to partner with an EOR. However, it is essential to choose a reliable EOR partner who accurately calculates employer burden and doesn’t mark up costs for profit.

Overpayments

Trust is fundamental to your relationship with an EOR. As you expand to a new market, an EOR is there for you along the way, providing quotes for costs like employer burden and local Value-Added Tax (VAT). Employers who choose to work with an EOR must ensure their EOR partner provides accurate quotes.

Some EORs even inflate employer burden calculations and VAT quotes for profit, which underscores the need to take your time finding an EOR partner that is diligent and honest.

Let Pebl handle the complex stuff—so you can focus on what you do best

Calculating true employee costs across multiple countries isn’t just overwhelming—it’s a full-time job that requires expertise most companies don’t have in-house. You could spend months trying to figure out the compliance requirements for hiring in Germany, Brazil, and Singapore. Or you could partner with people who already know the rules, like Pebl.

We’ve built our entire business around getting these calculations right the first time. Our pricing accuracy sits at 99.63% because we don’t guess—we know. Our teams are constantly tracking changes in labor laws, tax requirements, and local regulations across 185+ countries, so you don’t have to become an expert in international employment law.

When you work with us, you get transparent costs from day one. No hidden fees popping up three months later. No “Oh, by the way, there’s an additional compliance charge” conversations. Just honest numbers that let you budget accurately and make confident hiring decisions.

We handle everything that comes after the hire, too—onboarding, payroll, benefits, compliance, and HR support. You get to focus on finding amazing talent and growing your business, while we deal with the maze of international employment requirements.

You can build your global team quickly and confidently, knowing that every hire is compliant, every payment is accurate, and every cost is transparent.

Ready to see what hiring internationally looks like when someone else handles the complexity? Let’s talk about your specific situation and show you exactly what it would cost to hire in the countries on your list.

This information does not, and is not intended to, constitute legal or tax advice and is for general informational purposes only. The intent of this document is solely to provide general and preliminary information for private use. Do not rely on it as an alternative to legal, financial, taxation, or accountancy advice from an appropriately qualified professional. The content in this guide is provided “as is,” and no representations are made that the content is error-free.

© 2025 Pebl, LLC. All rights reserved.

Topic:

Payroll